Banks in the UAE are expected to record an increase in lending this year as the Arab world's second-largest economy charts a strong recovery from the Covid-19 pandemic, according to a new report.

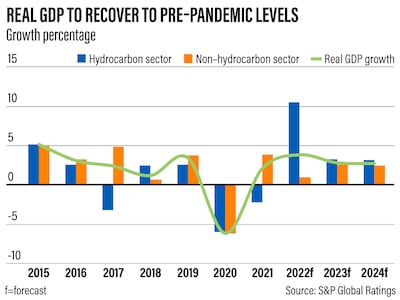

Higher oil prices, supportive government policies and improving economic sentiment could lead to a faster return to pre-pandemic levels, S&P Global Ratings said in a report.

“We have raised our assumption for Brent oil prices to an average of $85 in 2022,” S&P Global said. “We expect nominal gross domestic product to reach pre-pandemic levels supported by activity from the ongoing Expo 2020 in Dubai and a recovering hydrocarbon sector.”

Oil prices surged on Thursday after the Opec+ 23-member alliance of producers stuck with its production plans for April and the Ukraine-Russia crisis continued.

Brent, the global benchmark for two thirds of the world's oil, rallied to more than $119 per barrel on Thursday, its highest level since May 2012. West Texas Intermediate, the gauge that tracks US crude, also surged to more than $116 a barrel, its highest since 2008.

Prices receded late on Thursday and by 12.36pm UAE time on Friday Brent was trading at $110.7 and WTI at $108.1.

Banks in the UAE, including First Abu Dhabi Bank, Emirates NBD, Abu Dhabi Commercial Bank and Dubai Islamic Bank, among others, have all reported higher 2021 profits as the country’s economy recovers from the pandemic, helped by higher oil prices and fiscal stimulus measures. Combined net profit of the country's four largest banks was up 31 per cent to $8bn in 2021.

Lenders in the UAE are expected to return to pre-pandemic levels of profitability in the next 12-18 months amid stronger net income, a decline in non-performing loans and improved business momentum, Moody's Investors Service said in a separate report last month.

Any non-performing loan increase will be contained in the banks as corporate activity and the economy improve.

S&P Global also estimated that the UAE Central Bank will mirror the US Federal Reserve’s planned interest rate hikes, a move that could benefit local banks' profitability. The Fed is convening on March 15-16 when it is expected to raise rates by 25 basis points.

“We calculate a 15 per cent increase in net income and 1.4 per cent rise in return on assets for every 100-basis-points increase (parallel shift) based on the top 10 banks’ disclosures,” the ratings agency said.

“We expect the cost of risk to stabilise, so we think UAE banks’ profitability will keep improving, reaching pre-pandemic levels by 2023.”

Increased profitability is also expected to further strengthen the banks' capital buffers with many expected to start paying their dividends at pre-pandemic levels this year, the agency said.

Local lenders have actively cut costs, embarked on massive digitisation drives to tap into a growing pool of tech-savvy consumers and reduced their real estate footprints to support their performance, the report said.

UAE banks are also only expected to see a limited impact from the Ukraine-Russia crisis since they have limited exposure to these regions.

However, the lenders could possibly see an impact through higher oil prices that could further boost the UAE's economic momentum. But the ratings agency does not expect lending growth to outpace its current projection.