The proposed move by Rolls-Royce Holdings to tap investors for up £2.5 billion (Dh11.79bn) to bolster its balance sheet comes as the company "stares down the barrel of a shotgun", analysts warned on Monday.

The British maker of aircraft engines said on Saturday it was in talks with sovereign wealth funds, including Singapore’s GIC, as it mulls “funding options to enhance balance sheet resilience and strength”.

However, analysts warn that the company is “facing a critical time” when the aviation sector is already seriously hampered by the effects of the Covid-19 pandemic.

"Rolls-Royce now has liabilities that exceeds its asset values. Its credit rating is also battered, making new finance options more costly and limited," Saj Ahmad, chief analyst at StrategicAero Research, told The National. "One might suggest the company is in freefall. It's not quite there yet, but it is staring down the barrel of a shotgun because there simply isn't a white knight out there in the aerospace world to save them."

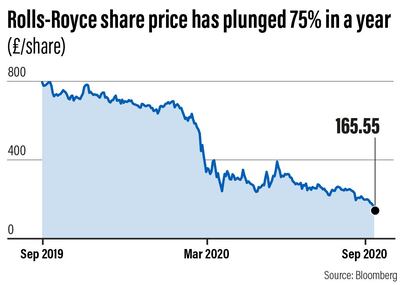

Rolls-Royce shares hit their lowest level since 2004 on Monday – falling 8.41 per cent to £165.00 at 2pm London time - after the company confirmed the possibility of making a rights issue following months of speculation about the state of its finances.

“Amongst other options, we are evaluating the merits of raising equity of up to £2.5bn, through a variety of structures including a rights issue and potentially other forms of equity issuance. Our review also includes new debt issuance,” Rolls-Royce said in a statement on Saturday.

“No final decisions have been taken as to whether or when to proceed with any of these options or as to the precise amount that may be raised.”

It declined to comment further on the equity raise when approached by The National on Monday.

Given the low share price, raising new equity would be a last resort for the company, Agency Partners analyst Nick Cunningham told Reuters.

Britain's best-known engineering company, which also makes engines for ships and powers the UK's nuclear submarines, has been badly affected by the pandemic because airlines pay the company according to how many hours its engines fly. As demand for the wide-body planes its engines power, such as the A380, dwindling, the company has seen the maintenance revenue it collects when they fly disappear. It recorded a post-tax loss of £5.4bn in the first half of 2020.

Like many segments of the UK’s manufacturing sector affected by the pandemic, Rolls-Royce is planning wide-ranging job cuts and moving some production overseas. In May, the company said it would cut at least 9,000 jobs, mainly in civil aviation, amid the slump in air travel. Last month it unveiled plans to sell its Spanish unit ITP Aero and other assets in a move to raise at least £2bn.

In August the company said it had taken “rapid management actions to reduce costs and secure additional liquidity”, starting the second half of 2020 with liquidity of £6.1bn (comprising £4.2bn cash at the end June and a £1.9bn undrawn revolving credit facility) and finalising a £2bn undrawn term loan, partly backed by the UK Export Finance.

However, StrategicAero Research's Mr Ahmad, said more action is needed.

“Rolls-Royce's strategy to sell off assets to generate cash is a limited option - what will they do when there's nothing left to sell?” he said.

Questions should be raised around the company’s decision to be "a sole engine supplier on the abject selling A330neo, the bulk of whose customers are all junk credit rated and themselves now cannot commit to buy the aeroplanes they thought they could", Mr Ahmad said.

"All in, it’s not surprising that Rolls-Royce has burned through so much cash this year," Mr Ahmad said. "Coupled with its questionable strategy to align its major products solely to Airbus ... Rolls-Royce has next to no income while its costs are still there to address. This is why their half year results were devastating and it doesn’t look like the next half is going to be any better either."