India's airlines are facing a “crisis” that could result in a quarter of the sector's fleet grounded by March next year because of supply chain problems delaying replacement plane engines, according to analysts.

It is a critical time for the industry, as the country's airlines focus on increasing profitability and capitalising on rising travel demand as the sector continues to recover from the coronavirus pandemic.

“India's fragile aviation ecosystem can't afford for the supply chain issues to be more severe,” says Kapil Kaul, chief executive and director of aviation consultancy Capa India.

“That could see the situation evolve from an airline risk to an industry risk.”

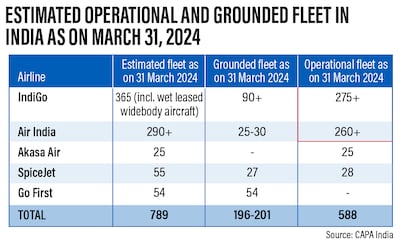

By March 31, Capa forecasts that up to 200 aircraft will be grounded in India, from more than 160 planes now.

This is expected to result in constrained capacity, leading to more flight cancellations and delays and a “crisis situation”, Mr Kaul says.

The issue comes as India's aviation sector, like those of many other countries, is still recovering from the impact of the pandemic, as well as dealing with other challenges, such as rising competition and high taxes.

Combined, India's airlines reported losses of $6 billion between April 2020 and March 2023, according to Capa. This financial year, the consultancy projects that Indian airlines will incur losses of between $1.6 billion and $1.8 billion.

Demand for travel in India has been soaring since pandemic restrictions were eased. The country's aviation industry handled about 200 million passengers in the financial year to the end of March 2023.

Domestic air traffic in India increased by 9 per cent year-on-year last month to reach 12.7 million passengers, according to data released by the country's Directorate General of Civil Aviation.

Mumbai's international airport reported its highest monthly passenger traffic at 4.46 million last month, an increase of 13 per cent compared with the same period last year.

A significant issue is the challenge in the global supply chain for spare parts and services from engine suppliers, analysts said.

Although it is a challenge faced by airlines worldwide, Capa says India is especially vulnerable because it has a high proportion of narrowbody planes in its fleet – and these are the aircraft primarily affected by engine issues.

“The expected [increased] grounding of India's fleet is concerning,” says Manish Chowdhury, head of research at StoxBox.

The situation is expected to worsen despite other carriers such as Air India, Indigo and Akasa Air expected to add about 150 planes collectively in the next 12 months, Mr Chowdhury says.

“We believe that the capacity addition is not enough to cater to the increasing air traffic and would result in airfares remaining high in the near future,” he says.

“Additionally, the grounding of aeroplanes would create a shortage of parking bays.”

The situation impacts several airlines, including IndiGo, India's largest by fleet size.

It has been forced to ground dozens of planes because of issues with US manufacture maker Pratt & Whitney's engines, as replacements are needed.

In July, another problem surfaced: a rare powder metal defect that could cause cracking of some engine components in the twin-engine Airbus A320neo planes.

This means that inspections will have to be carried out on these aircraft. Capa forecasts that 90 IndiGo planes will be grounded by the end of March, up from 50 to 60 now.

To manage the situation, IndiGo has been leasing planes to meet demand and remain on its growth path.

During the airline's latest earnings call last month, Gaurav Negi, IndiGo's chief financial officer, said it had received further communication from Pratt & Whitney over the powder metal issues.

“We understand that a large number of ... engines are being removed for shop visits between 2023 and 2026 and a majority of these incremental engine removals are planned for 2023 and early 2024,” Mr Negi said.

“Our current estimates indicate that these accelerated removals and incremental shop visits will further adversely impact our operating fleet from the fourth quarter onwards, which is post-January 1, 2024, and would lead to a higher number of groundings.”

Aside from leasing more aircraft to overcome the issue, the airline is also using some of its older aircraft. At the same time, it expects leasing costs to be offset by growing demand and the limited capacity in India's aviation sector.

“With these mitigation initiatives, we reiterate our financial year 2024 capacity growth guidance of north of mid-teens and we also remain confident in meeting our long-term capacity guidance,” Mr Negi said.

IndiGo's chief financial officer

However, the financial impact on IndiGo will be “severe”, according to Mr Kaul.

“IndiGo's scale and a 60 per cent domestic share that's core to India's connectivity is a critical national asset,” he adds.

“To have so many aircraft grounded, with possibly more in [the next financial year] may have larger economic implications.”

Meanwhile, the financial impact – at a conservative level – is $6 million per aircraft annually, Capa says.

Other airlines are also feeling the heat.

Budget airline Go First's entire fleet of 54 planes is grounded. The carrier filed for bankruptcy in May, blaming Pratt & Whitney for its troubles.

The company said its financial problems were “due to the ever-increasing number of failing engines supplied by Pratt & Whitney”.

It also accused Pratt & Whitney of refusing to supply usable engines under an emergency arbitration award that resulted in cash flow issues. Pratt & Whitney has rejected the allegations.

Another Indian low-cost airline, SpiceJet, is struggling to recover after Boeing's 737 Max planes were grounded globally in 2019. It took two and a half years before the carrier could resume flying 737 Max planes.

“This year, the challenges were further compounded by elevated fuel prices, impacting operational costs,” Ajay Singh, chairman and managing director of SpiceJet, said on Tuesday, as the company announced that its board had approved raising $270 million by selling sales and warrants.

Air India, privatised in January 2022 with its handover to Tata Sons, is also facing supply chain issues, with more than 40 planes short of parts. Capa expects that up to 30 of Air India's planes will be grounded at the end of March.

“2024 will be crucial for the Indian aviation sector, with traffic coming up,” says Khushboo Vaish, senior director at professional services company Alvarez & Marsal.

“Airlines will still be able to meet the demand with re-inductions [of planes] but we might see more operational challenges in terms of network changes and scheduling,” she says.

“There is a healthy recovery in passenger traffic but an uncertain global situation impacting aviation turbine fuel and the exchange rate, along with engine groundings, means 2024 will be an operationally challenging year for the aviation sector.”

More investment in maintenance, repair and overhaul facilities, both within India and globally, could be an effective longer-term solution to easing such problems, analysts say.

Airlines may be able to weather the storm in the coming months with older aircraft, short-term leases and new plane deliveries, but there is still some uncertainty about the outlook beyond that, Ms Vaish says.

“The bigger and more crucial aspect to wait and watch will be how fast engine manufacturers are going to deal with this issue in 2024, as it might have a higher impact in 2025 to 2026,” she says.