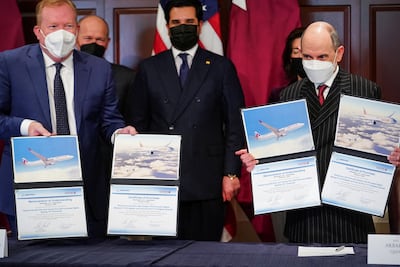

Boeing won a launch order from Qatar Airways for the new freighter version of its 777X wide-body jet in a multibillion dollar deal signed in Washington on Monday.

The US plane maker's share price closed 5 per cent higher at the end of market trading after it sealed the largest cargo plane commitment in its history by value.

Here is a look at the significance of Boeing's freighter deal for the company, its potential airline customers and the booming global air cargo market.

What is the new 777X freighter?

On January 31, Boeing launched the 777-8 freighter, the world’s largest twin-engine cargo jet. The plane has the highest payload and the lowest fuel use, emissions and operating cost per tonne of any large freighter, according to Boeing. It will offer a 25 per cent improvement in fuel efficiency while reducing emissions and operating costs by the same magnitude.

It builds on advanced technology from Boeing's new 777X passenger jet and its current best-selling 777 cargo plane.

With a revenue payload of 112.3 tonnes and a range of 4,410 nautical miles (8,167km), the 777-8 cargo plane has the lowest fuel use, emissions and operating cost per tonne of any large freighter, according to Boeing.

The first delivery of the plane, which is powered by General Electric's GE9X engines, is scheduled for 2027 when many operators will be looking to replace ageing 747-400 cargo planes later this decade.

Qatar Airways signed an order worth $6.8bn for GE9X engines as part of its 777-8 freighter commitment.

Boeing will build the 777-8 freighter at its factory in Everett, Washington state, once its technical team completes the jet's detailed design.

What does the new 777X freighter launch mean for Boeing?

This is the first order for a freighter version of the world's largest twin-engine passenger plane, whose debut is running three years behind and is scheduled for late 2023.

The deal offers a silver lining for the Chicago-based plane maker as it grapples with the impact of the Covid-19 crisis, production issues on the 787 Dreamliner and delays to the release of its 777X passenger version.

"The launch of the 777X freighter could become a major lifeline for Boeing as they have been struggling with multiple crises," said Linus Bauer, founder and managing director of Bauer Aviation Advisory.

The deal is a "welcome victory" for Boeing, given the numerous delays that have affected the delivery of the 777X, he said. The delivery of the passenger jet was originally planned for 2020.

What is the state of the global air cargo market?

The freighter deal comes amid a boom in the global air cargo market despite the Covid-19 pandemic. Driving that demand is the surge in e-commerce sales, supply chain disruptions and competitive air cargo prices when compared with sea freight.

Global demand for air cargo increased 6.9 per cent in 2021, compared with pre-coronavirus levels in 2019, and strong growth has been forecast for 2022, according to Iata.

"The recent cargo aircraft orders and aircraft conversion activities clearly prove that the freighter market remains strong even as Airbus and Boeing continue to struggle to make large aircraft order deals on the commercial side of the aviation business," Mr Bauer said.

_____________________

Boeing 777X at Dubai Airshow

_____________________

What is the significance of the deal's timing?

The deal comes as Boeing and its European arch-rival Airbus face off in the large freighter jet market.

Boeing has long held an iron grip on the cargo market with its range of freighters — including the 747F, 767F and 777F wide-body aircraft — that make up most of the world's cargo fleet.

However, Airbus has sought to loosen Boeing's hold, launching the A350F, a freighter version of its latest passenger plane, in 2021.

"Cargo carriers like Emirates and Qatar Airways are already aware of Boeing’s strengths in developing freighter aircraft, as nearly every one of Boeing’s commercial aircraft has a freighter variant to date," Mr Bauer said.

"However, Airbus’ successful unveiling of the new A350F variant in 2021 will challenge Boeing in the growing cargo aircraft segment of the market."

Qatar Airways' order with Boeing also comes after a months-long, bitter dispute with Airbus over paint defects on A350 passenger jets that is currently before the courts.

"Launching the 777x freighter really continues the line of new-build freighters for Boeing and will be important to customers that need the larger sizes, especially as the 747F is retired," said George Ferguson, Bloomberg Intelligence's aviation analyst.

"The 777X will be larger than the A350-1000 and the largest new-build freighter on the market."

How robust is airline demand for freighters amid the pandemic?

The replacement of ageing planes and acquisition of newer ones to drive growth will create demand for 2,610 cargo planes around the world in the next 10 years, Boeing said in its latest 2021-2040 market outlook.

Of these, 890 jets will be aircraft that roll off the production line as freighters. The remaining 1,720 are expected to be passenger aircraft conversions, Boeing said.

"Airlines have gained broader appreciation of air freight during the pandemic; it has been a lifeline in the absence of passenger traffic," aviation analyst John Strickland said.

"Beyond the pandemic, supply chain challenges and growing demand for e-commerce will boost demand for air freight."

Air cargo demand is expected to remain robust beyond the pandemic, Mr Ferguson said.

"The pandemic has spurred a lot of demand for freighters but the 777X will be larger than most and a new build, so that should support long-term demand," he said.