The decision by the warring Ambani brothers to call a truce is expected to boost investor confidence in the two Reliance group of companies under their control in India. Mukesh and Anil Ambani decided on Sunday to end a bitter family feud by scrapping a deal they signed in 2006 barring them from competing with each other's businesses. The billionaire brothers will now be free to go head to head, with the exception of investments in power plants fired by natural gas, removing a source of friction between the two conglomerates, Reliance Industries (RI) and Reliance Anil Dhirubhai Ambani Group (ADAG).

"We believe the new agreement is positive for [RI], as it opens up opportunities for growth in new sectors within India," analysts at Goldman Sachs said in a note. "But given the competitive landscape in telecom, financial services, etcetera, any potential entry by [RI] could be in the form of co-operation with ADAG or via industry consolidation, in our view." Shares in the energy major RI, which is India's most valuable company at US$73 billion (Dh267.91bn) and is controlled by Mukesh, the older brother, were up 3.5 per cent at 1,030.90 rupees in afternoon trading yesterday after rising as much as 5.3 per cent in early trading.

The Anil Ambani-controlled Reliance Communications, which is India's number two mobile phone operator, jumped 6.1 per cent, while Reliance Natural Resources (RNR) climbed 20 per cent. "Sentimentally this is good news, as uncertainty over the disputes finally ends," Gaurav Dua, the head of research at the Mumbai brokerage Sharekhan, told Agence France-Presse. After RNR became embroiled in a dispute with RI over the price of natural gas, India's highest court ordered the brothers to renegotiate within six weeks a private supply contract between the two companies.

The court ruling on May 7 prompted Sunday's announcement, which could finally end the feud between the two brothers, who are estimated to be worth a combined $43bn. In statements, they said they were "hopeful and confident" of creating an "environment of harmony, co-operation and collaboration". "These developments will eliminate any room for further disputes between the two groups," the statement said.

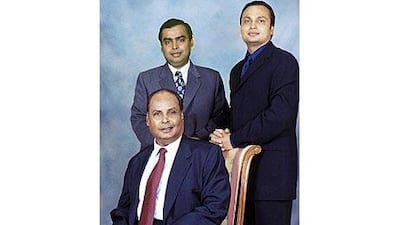

The new pact has been well received. "Investors were cautious on [RI] and the dispute had kept many away from ADAG," Aneesh Srivastava, the chief investment officer at IDBI Fortis Life Insurance told The Economic Times. "However, this will result in a change of sentiment." A lot will hinge on the new deal. The Ambani brothers split the Reliance business empire built by their father, the late Dhirubhai Ambani, in 2006 after a deal brokered by their mother after their father died intestate.

Mukesh was handed the oil, gas, and petrochemicals operations while Anil took control of the power, finance and telecommunications businesses. But the division was far from perfect. In the past 18 months, the gas dispute had been closely watched by foreign investors because of a lack of clarity about India's energy policy. The image of a wealthy family at war with itself was also hurting India's profile as an investment destination.

"The Ambani brother dispute seriously hurts investors' confidence in India and that spells danger for future generations here who will need a greatly expanded energy supply to power their dynamic economy," a report last year in the US magazine Energy Tribune highlighted. To illustrate that point, the 2006 "non-competition deal" scuppered plans for a major north Indian power station, while a merger between Reliance Communications and South Africa's MTN Group was ditched.

Now both Reliance groups will be able to compete in each other's markets, which should spark substantial growth, although some analysts say the new pact favours Mukesh. "If you weigh the positives and negatives, this is more positive for [RI] because this gives it an opportunity to look into expansion in other areas, which they were not allowed to do earlier," said SP Tulsian, an independent consultant in Mumbai.

"You can't rule out the possibility of Reliance entering sectors [where ADAG monopolises the market] such as telecom." Other observers point to the fact that the joint market value of RI and the five ADAG companies has more than tripled to at least $92bn from $29bn before the deal in 2006. "They made more money separately," said Kavil Ramachandran, a professor of family business and wealth management at the Indian School of Business in Hyderabad. "That's not to say they can't make even more money if they work together."

@Email:business@thenational.ae