Live updates: Follow the latest on Israel-Gaza

Israeli arms manufacturers recorded their highest revenue yet last year, leading the Middle East market with sales reaching unprecedented levels driven by operations in Gaza, a new study has shown.

Aggregate revenue of those companies increased 15 per cent annually to $13.6 billion last year, placing the country eighth worldwide in terms of total arms revenue share, the Stockholm International Peace Research Institute said in a report on Monday.

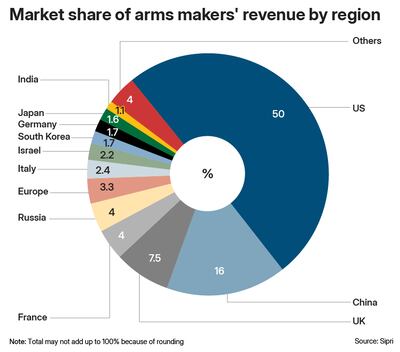

That is about a 2.2 per cent share of the $632 billion total revenue posted by arms makers last year, which is a 4.2 per cent year-on-year increase, Sipri said. Turkey was the only other country from the region to be represented on the list.

The Solna-based institute defines arms revenue as those generated from the sales of military goods and services to military customers domestically and abroad.

Israel's Elbit Systems, ranked 27th, posted an annual revenue increase of 14 per cent to $5.4 billion, after securing about $900 million from military-related domestic contracts between October and December last year.

Israel Aerospace Industries, at 34th, reported that last year was a record, with revenue up 15 per cent at $4.5 billion, while 42nd-ranked Rafael Advanced Defence Systems said revenue grew 16 per cent to $3.7 billion, as both companies boosted their production of arms and new systems for the country's military.

Israel Aerospace says it operates in varied markets globally while Rafael's customers include 20 Nato countries supported by 30 subsidiaries and joint ventures, according to their websites. Elbit has been awarded contracts by a number of countries.

“The biggest Middle Eastern arms producers in the Top 100 saw their arms revenue reach unprecedented heights in 2023 and the growth looks set to continue,” Diego da Silva, a senior researcher at Sipri and one of the report's authors, said.

In particular, aside from taking in record arms revenue last year, Israeli arms producers are booking many more orders as the war in Gaza, which had just entered its second year, rages on. The Sipri report did not take into account any potential effects from Israel's other conflicts with Iran and Lebanon, which began in April and October, respectively.

The US remained the world's top country for arms manufacturing, with 41 companies from the world's biggest economy combining to post $317 billion in revenue last year, which is a 2.5 per cent year-on-year increase, Sipri said. Industry major Lockheed Martin remained No 1, despite its revenue dropping 1.6 per cent – a third consecutive annual decline – to $60.8 billion.

That gave America a commanding 50 per cent market share, well ahead of second-placed China, whose arms industry revenue market share was at 16 per cent, comprising nine Chinese companies whose revenue inched up 0.7 per cent at $103 billion last year.

The UK was third with a 7.5 per cent market share, with seven companies in the top 100 combining to post $47.7 billion revenue. That is part of a broader 27 companies from Europe, whose revenue marginally rose 0.2 per cent to $199 billion, accounting for 21 per cent of the top 100's total.

France and Russia were next with a market share of 4 per cent each. The latter, in particular, only had two companies – Rostec and USC – but combined for a revenue of $25.5 billion last year, which was 40 per cent year-on-year increase, primarily due to Russia's war with Ukraine, which is nearing its third year in February.

The sharp overall rise in Russian companies’ arms revenue was attributed to increased production of various arms “as a response to the military’s changing demands since the start of the war in Ukraine”, Sipri said.

In Asia and Oceania, 23 companies in the top 100 posted a 5.7 per cent arms revenue annual growth to hit $136 billion, with South Korea and Japan leading. Military expenditure is considered a critical component especially for major economies to ensure their national security and influence in international matters.

Spending rose for the ninth straight year last year to hit a record $2.443 trillion, and across all the five geographical regions defined by Sipri for the first time since 2009, it said in an April report.

That rise is a “direct response to the global deterioration in peace and security”, as states continue to prioritise military strength, Nan Tian, a senior researcher at Sipri, had said.