Shares of Intel jumped in after-hours trading on Thursday even as the company reported its largest ever quarterly loss but said its gross margins will improve in the second half of the year.

Intel, the world's largest chip maker by revenue, reported a net loss of $2.8 billion in the January-March period, down from $8.1 billion net profit in the same period last year, but less than analysts estimates.

The results surpassed the previous highest quarterly loss of $687 million reported in the fourth quarter of 2017. The company’s revenue decreased 36 per cent on an annualised basis to $11.7 billion, Intel said in a statement.

Intel estimates that gross margin, or the segment of sales that remains after subtracting the cost of production, will be 37.5 per cent in the second quarter.

The company's stock price, which is up nearly 12 per cent since the start of the year, settled about 3 per cent higher to $29.86 at market close on Thursday. Shares jumped 5 per cent in after-hours trading.

“You normally have a stronger second half in our industry, and we expect that to be the case,” Intel chief executive Pat Gelsinger said on a conference call Thursday. “We’re seeing some green shoots in the marketplace. But we think it’s a tough market for all.”

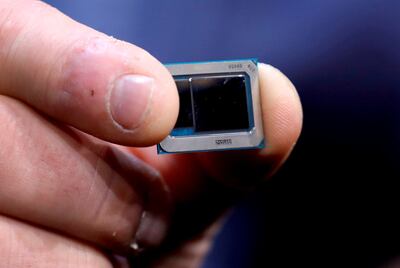

Since Intel’s founding in 1968, it has been an integrated device manufacturer — a company that both designs and builds its own semiconductor chips.

In March 2021, Mr Gelsinger announced IDM2.0, a new model that includes significant manufacturing expansions.

“We delivered solid first-quarter results, representing steady progress with our transformation,” Mr Gelsinger said in a statement announcing the earnings results.

“We hit key execution milestones in our data centre road map and demonstrated the health of the process technology underpinning it,”

In the first quarter, Intel spent more than $5.4 billion on research and development activities, about 11 per cent less than the R&D spend of the same period in 2022.

The company reported an operating loss of almost $1.5 billion in the quarter, from an operating income of $4.3 billion in the same period last year.

One of Intel's turnaround plans is to open up its factories as foundries, or workshops, that can make chips for other brands.

“We still have more work to do as we re-establish process, product and cost leadership, but we continue to provide proof points each quarter,” Mr Gelsinger said on an earnings call.

In the January-March period, Intel also paid dividends of $1.5 billion.

Intel said it expects the current quarter sales to reach between $11.5 billion and $12.5 billion.

“We … continued to be disciplined on expense management as part of our commitment to drive efficiencies and cost savings,” said David Zinsner, Intel’s chief financial officer.

“At the same time, we are prioritising the investments needed to advance our strategy and establish an internal foundry model, one of the most consequential steps we are taking to deliver on IDM 2.0.”

The company said it had more than $8.2 billion in cash and cash equivalents as of April 1, down from $11.1 billion at the end of last year.

Its client computing group, which produces chips for personal computers, added $5.8 billion in overall sales in the first quarter — almost 38 per cent less than the same period last year.

The company earned $3.7 billion from its data centre and AI division, nearly 39 per cent down on a year-on-year basis.

Sales of Intel’s autonomous driving subsidiary Mobileye were up about 16 per cent to $458 million in the three-month period.

“While we remain cautious on the macroeconomic outlook, we are focused on what we can control as we deliver on IDM 2.0 … driving consistent execution across process and product road maps and advancing our foundry business to best position us to capitalise on the $1 trillion market opportunity ahead,” Mr Gelsinger said.