Shares in Adani Group companies fell after US investor Hindenburg Research said it was shorting the conglomerate’s stocks and accused companies owned by Asia’s richest man of “brazen” market manipulation and accounting fraud.

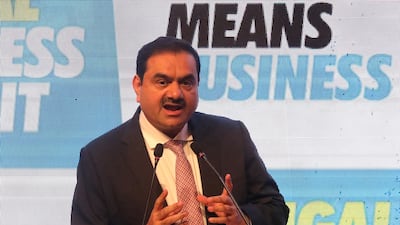

Billionaire Gautam Adani’s flagship company Adani Enterprises and Adani Ports and Special Economic Zone dropped as much as 3.7 per cent and 7.3 per cent respectively on Wednesday despite relatively small free-floats.

It came after Hindenburg, a US-based investment research firm that specialises in activist short-selling, made wide-ranging allegations of purported corporate malpractice following a two-year investigation into the tycoon’s companies.

Cement makers ACC and Ambuja Cements, Mr Adani’s recent acquisitions which are more widely traded, plunged by as much as 7.2 per cent and 9.7 per cent.

The 2032 dollar bond issued by Adani Ports sank 7 cents to 71.5 cents on the dollar, its biggest drop since issuance in 2021, according to data compiled by Bloomberg.

Adani Green Energy’s note maturing in 2024 fell 2.7 cents to 92 cents, the most in three months.

Hindenburg’s January 24 report, constituting the research company’s opinions and investigative commentary where readers are advised that use of the report is at the reader’s own risk, details a web of Adani family controlled offshore shell entities in tax havens. It claims these were used to facilitate corruption, money laundering and taxpayer theft, while siphoning money from the group’s listed companies.

The report is “a malicious combination of selective misinformation and stale, baseless and discredited allegations”, Adani group chief financial officer Jugeshinder Singh said.

The report was released on the same day that a key share sale from Adani Enterprises, aimed at attracting a broader network of investors, is set to open for subscription.

The timing “clearly betrays a brazen, mala fide intention to undermine” and damage the share sale plan, said Mr Singh.

The broadside from Hindenburg comes at a critical time for the ports-to-power tycoon.

Mr Adani is seeking to raise his international profile and is aggressively branching into new businesses, including cement and media, in his power base of India, where he is seen to enjoy a close relationship with Prime Minister Narendra Modi.

The Adani empire’s expansion plans are closely aligned to the government’s development and economic goals.

Mr Adani rocketed up the Bloomberg Billionaire’s Index last year past the likes of Bill Gates and Warren Buffett, and his fortune is now $118.9 billion, making him the fourth-wealthiest person in the world.

While many of the allegations made by Hindenburg against Mr Adani were already known, including over-valuations and concentrated holdings by Mauritius-based investors in his companies, some details gleaned from the entire Mauritius registry have been made public for the first time, said Brian Freitas, an Auckland-based analyst who publishes independent research on website Smartkarma.

“It will not only shine a light on the group, but also on corporate governance in India,” said Mr Freitas.

But the report is unlikely to have “any big impact on the follow-on offer because the company would have ensured that there is sufficient demand for the book to be covered”.

A prominent research outfit, Hindenburg is best known for its critical reports on the electric vehicle space. It was instrumental in bringing down the founder of e-truck company Nikola, which was accused by Hindenburg in 2020 of being built on “dozens of lies”.

Nikola founder Trevor Milton eventually stepped down as chairman and was found guilty of securities fraud. More recent targets include Clover Health and Lordstown Motors.

Hindenburg said it had taken a short position in Mr Adani’s companies through US-traded bonds and non-Indian-traded derivative instruments.

Some of their main allegations include: the offshore shell network seems to be used for earnings manipulation; Adani Group has previously been the focus of four major government investigations relating to allegations of fraud; and that the auditor “hardly seems capable of complex audit work” when Adani Enterprises alone has 156 subsidiaries and many more joint ventures.

Adani companies trade at price-to-earnings ratios many times that of peer companies both in India and around the globe, including companies in the Reliance empire of rival tycoon Mukesh Ambani — Mr Adani’s predecessor as Asia’s richest man.

There are some signs that the bull run is slowing, with most Adani group stocks starting the year with declines even before Hindenburg’s report.

Investors and analysts have also flagged concerns over the high levels of debt seen in the empire’s listed units.

Gross debt at six Adani firms — Adani Enterprises, Adani Green Energy, Adani Ports, Adani Power, Adani Total Gas and Adani Transmission — stood at 1.88 trillion rupees ($23 billion) as of the end of March 2022.

“Even if you ignore the findings of our investigation and take the financials of Adani Group at face value, its seven key listed companies have 85 per cent downside purely on a fundamental basis owing to sky-high valuations,” Hindenburg said in the report.