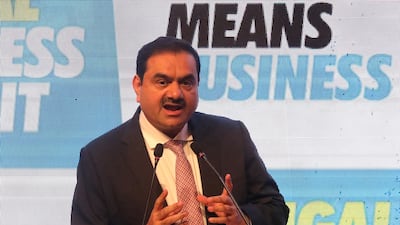

Asia’s richest man, Gautam Adani, plans to sell shares to the public in at least five companies between 2026 and 2028, helping the port-to-power conglomerate improve debt ratios and broaden its investor base.

“At least five units will be ready to go to the market in the next three to five years,” Jugeshinder Singh, Adani Group chief financial officer, said.

He said Adani New Industries, Adani Airport Holdings, Adani Road Transport, AdaniConnex and the group’s metals and mining units would become independent.

Mr Singh said businesses such as the airport operator are consumer platforms servicing nearly 300 million customers and need to operate on their own and manage their capital requirements for growth.

He said the businesses would need to show they can pass the basic tests of independent execution, operations and capital management before a formal demerger can take place.

“Scale is already there for the five units,” Mr Singh said. The “airport business is already independent, while Adani New Industries is going strong on the green energy side. Adani Road is demonstrating new build-operate-transfer models to the nation, while the data centre business will grow further. Metals and mining would cover our aluminium, copper and mining services”.

The billionaire has faced criticism over the group’s rapid expansion from a traditional port operator to a conglomerate with assets including media, cement and green energy that some say has increased debt and financial complexity.

Research company CreditSights raised a red-flag over the Adani Group’s “elevated” leverage last year. The group pushed back against the report, saying leverage ratios were “healthy”.

The conglomerate’s flagship company Adani Enterprises is scheduled to sell new shares at a discount and allow payments in three instalments when it rolls out a $2.5 billion follow-on offer later this month — an unusual move for one of the country’s major stocks that is designed to attract retail investors.

A diversified shareholder base would help make the thinly traded stock more liquid and provide funds to pay down debt.

Adani Group has consistently aligned itself to support Prime Minister Narendra Modi’s agenda. It has pledged more than $70 billion to help India pivot from fossil fuel importer to generator of renewable energy.