During a June 2020 visit to its facility in Ruwais, Sheikh Mohamed bin Zayed, praised the Abu Dhabi National Oil Company for supporting the country's economy throughout the coronavirus pandemic.

“I’m proud of the exceptional effort to ensure uninterrupted supply of oil and gas to support our national economy,” the UAE President and Ruler of Abu Dhabi, said.

“The UAE continues to develop its energy sector and advance industries to drive sustainable growth.”

When restrictions related to Covid-19 suddenly stopped economic activity in many sectors around the world, oil demand plummeted and prices crashed — with US benchmark crude prices turning negative in April 2020.

Adnoc showed an ability to manage the crisis well, as Sheikh Mohamed highlighted.

This resilience was built up over time, and particularly over the previous six years, as the state owned oil producer underwent a transformation that turned it into a far more commercially focused and efficient international company, unlocking billions of dollars of value along the way.

Ruwais was also at the heart of this vision, Adnoc developing it into a fully-fledged hub for its downstream ambitions.

The pandemic had not dimmed the plans for Ruwais or the overall trajectory for Adnoc to become one of the most efficient national oil companies in the world.

Interestingly, the spur for the company’s transformation strategy, overseen by Sheikh Mohamed, had been the earlier global oil price slump, when an excess of supply, particularly in the United States, resulted in the Brent crude benchmark dropping as to low as $27.88 a barrel in early 2016.

Dr Sultan Al Jaber, Adnoc managing director and group chief executive, told The National in 2017 that after “a comprehensive root-and-branch review of our entire business” in 2016, the aim was to make Adnoc “more efficient, performance-driven, flexible, resilient and competitive”.

The subsequent 2030 strategy and investment plan was approved by its board, which is chaired by Sheikh Mohamed.

Very swiftly, though, the impact of the start of the transformation was in evidence.

“Adnoc's initiative will expand strategic partnership opportunities, deliver strong financial returns, and support the UAE's future growth,” Sheikh Mohamed said in the summer of 2017.

Already, there had been some significant developments. In October 2016, there was the consolidation of offshore companies Adma and Zadco.

Then, in February 2017, the renewal of onshore concessions was concluded after deals with BP and China's CNPC and CEFC, bringing total awards of Dh20 billion.

These partnerships were in line with Sheikh Mohamed’s vision for global partnerships and co-operation.

And since, new discoveries have reinforced the country’s position as holder of the world's sixth-largest oil reserves and the seventh-largest gas reserves.

Adnoc is working to boost oil production capacity to 5 million barrels a day by 2030.

At the end of last year, the board approved Adnoc’s plans to spend Dh466 billion ($127bn) between 2022 and 2026, of which Dh160bn will be directed towards the local economy by the state energy producer.

The company aims to increase its national reserves of 4 billion stock-tank barrels of oil and 16 trillion standard cubic feet of natural gas.

Dr Al Jaber, who is also Minister of Industry and Advanced Technology, said last year, Sheikh Mohamed had ensured Adnoc’s success through “his directives, support, constant follow-up and care for details”.

A month after that visit to Ruwais by Sheikh Mohamed, the company formed a partnership with Abu Dhabi’s industrial holding company, ADQ, to develop a chemicals manufacturing hub at Ruwais.

There have been other innovative deals across the energy value chain.

A consortium of the world’s leading infrastructure and sovereign wealth funds signed an agreement worth $20.7bn (Dh76bn) in 2020 to invest in Abu Dhabi’s natural gas pipeline infrastructure.

The infrastructure deal, which followed a similar transaction involving Adnoc’s oil pipelines in 2019, was the largest in the energy sector that year and was negotiated successfully amid the challenges caused by the pandemic, including the limit on international travel.

This also represented how attractive the UAE is for foreign direct investment, even when FDI levels fall elsewhere in the world.

Also, subsidiaries such as Adnoc Drilling and Adnoc Distribution have been listed on local stock markets, positioning them for more growth and realising gains for the group.

Adnoc has also launched a trading arm to better commercialise its refined products, as well as a business for the trading of its oil to boost revenue.

In March last year, crude futures contracts tracking the UAE's flagship Murban grade began trading in New York.

Murban has joined the ranks of Brent and US gauge West Texas Intermediate in pricing and trading oil. This is expected to enhance the UAE’s global competitiveness.

Expanding its partnerships with strategic customers in Asia such as the world’s largest crude importer China, has helped build the resilience Sheikh Mohamed spoke of in Ruwais during the pandemic.

For example, China's President Xi Jinping visited the UAE in the summer of 2018 and met with leaders including Sheikh Mohamed, and a number of key deals were signed including for investment into petrochemicals.

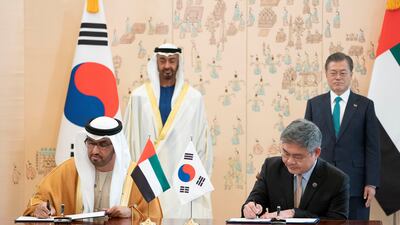

In 2019, Adnoc awarded South Korea’s SK Engineering & Construction a Dh4.4bn contract to build the world's largest single-site underground crude storage facility in Fujairah. This would greatly enhance energy security and the ability to respond nimbly to customers’ needs.

“Expanding strategic partnership opportunities of our national companies enhances their competitiveness and leadership regionally and globally,” said Sheikh Mohammed in 2017.

Looking beyond 2022, Adnoc has now branched out into areas that will become more important amid the energy transition and the UAE’s net zero by 2050 strategy, including blue ammonia, hydrogen and renewable energy.

These are key areas for the future prosperity for the country.

As Sheikh Mohamed said in October 2021, “Adnoc continues to drive innovation and efficiency in the energy sector and remains a crucial pillar of our nation’s economic success”.