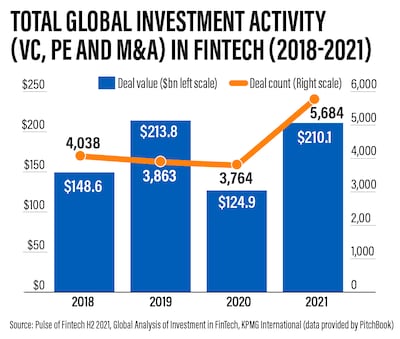

FinTech funding worldwide surged 68 per cent annually to $210 billion in 2021, a report by consultancy KPMG showed.

A record 5,684 deals were signed through mergers and acquisitions, private equity and venture capital last year, driven by subsectors such as payments and blockchain, the report found.

The payments segment continued to attract the lion's share of funding among FinTech subsectors, accounting for $51.7bn in investments globally.

It was followed by blockchain and cryptocurrencies, which attracted a record $30.2bn last year, up from $5.5bn in 2020 and more than three times the previous record of $8.2bn in 2018, the report said.

Demand for digital payments and other FinTech services has grown after the onset of the coronavirus pandemic as more people use online banking services to transfer money and pay for e-commerce transactions.

Globally, digital payments are expected to grow to $8.26 trillion by 2024, from $4.4tn in 2020, according to Statista.

Cyber security and wealth technology also attracted record investment of $4.85bn and $1.62bn, respectively.

Investment in FinTech companies in Europe, the Middle East and Africa (Emea) region stood at $77.4bn from 1,859 deals, said KPMG.

The Middle East, in particular, continued to report strong activity, with $75 million raised by Bahrain-based Rain and $50m by UAE-based Tabby in the second half of 2021.

“The UAE government has moved forward with a number of initiatives to foster the growth of FinTech,” Goncalo Traquina, head of Management Consulting, KPMG Lower Gulf, said.

“While much of FinTech investment in the UAE has been focused [on] the digital banking and payments space, lending is projected to grow on the back of AI [artificial intelligence] and machine learning being deployed to improve credit risk assessments.”

Growth in the FinTech deal sizes in the Middle East and Africa will be primarily driven by the payments sector this year, the consultancy said.

More than 800 FinTech companies operating in different segments such as payments, InsureTech and cyber security across the Middle East are expected to raise more than $2bn in venture capital funding this year to boost their growth, Dubai bank Mashreq said last month, citing data from the Middle East Institute.

Cryptocurrencies and blockchain are expected to retain their investor appeal in 2022, according to KPMG, as increasing numbers of crypto companies seek regulatory guidance to grow and develop the sector, especially in places such as the UAE.

Additional support from government-backed entities in the UAE has also helped local FinTech start-ups.

The Dubai International Financial Centre Innovation Hub, which is the largest cluster of FinTech and innovation companies in the region, allocated about $100m to help start-ups to grow through its FinTech fund accelerator programme.

The DIFC's FinTech hive has been connecting with investors and industry experts to seek funding.

Last October, the UAE Central Bank also signed an agreement with the DIFC to enhance collaboration under their shared sandbox programme for FinTechs.

“These, combined with start-up funds, are likely to be a big part of developing the UAE’s FinTech ecosystem over time,” KPMG said.

An increase in investment in decentralised finance in the Emea region and a stronger push for the development of a common regulatory framework for cryptocurrencies are also expected this year, the report said.

Globally, KPMG found that the largest FinTech deals in the second half of 2021 included the $9.2bn acquisition of Denmark-based payments processor Nets by Italy-based Nexi, the $3.75bn merger of FinTech cloud platform company Calypso Technology and regulatory technology solutions provider AxiomSL to form Adenza in the US, and the $2.7bn acquisition of Japan-based Paidy by PayPal.