Evergrande Group, China's second-biggest property developer by sales, currently poses a "limited" risk of triggering an economic crisis in the country as investors weigh the risks of a delayed intervention by the government to rescue the severely indebted company, according to the Bank of Singapore

Concerns about the potential default of Evergrande will heighten market volatility because of uncertainties around the company's fate but the risk of financial contagion will eventually be "relatively contained", the lender said in a research note on Monday.

"While we would not be surprised by heightened volatility as the market grapples with uncertainty regarding the resolution of Evergrande’s situation, and as investors weigh the risks of government intervention coming in too late to contain widespread contagion effects, our base case is that the risk of an economic crisis in China due to Evergrande is limited at this time," the report authors said.

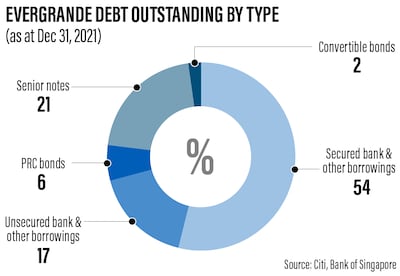

Evergrande, the world’s most debt-ridden property developer, has come under increasing scrutiny in recent months as the company grapples with a severe liquidity crisis due to a staggering debt pile of $300 billion.

On Monday, the company's share price fell as much as 17 per cent on Hong Kong’s benchmark Hang Seng stock index with Evergrande’s market value plunging to a record low of $3.54bn. The company's stock price is down 85 per cent since the start of the year. The fall in the stock price dragged the Hang Seng down 3.3 per cent on Monday, extending its decline since the start of the year to nearly 12.3 per cent.

Evergrande is the largest high-yield dollar bond issuer in Asia and a sizeable issuer in the onshore bond market, although not as significant compared to the offshore market.

"For now, the contagion from Evergrande’s risks has not spread beyond the real estate sector in China’s high-yield bond markets," the Bank of Singapore said.

In terms of the secondary effects of a potential Evergrande default on China’s banking sector, the company's direct borrowings from China’s banks is a small portion of the overall loan book of the banking sector as a whole, it said.

"Nonetheless, the impact is relatively uneven – selected banks have been reported to be vulnerable to Evergrande’s woes, including affiliated Shengjing Bank and national Mingsheng Bank," the report said.

China's domestic banking system is potentially exposed to Evergrande’s supply chain, including many suppliers and construction contractors for whom Evergrande was usually its largest customer, it said.

Of the company’s total liabilities, approximately half are supplier credit or trade payables.

"The Chinese government would also need to manage potential overly adverse spillovers to real estate prices and engineer a soft landing," the report said.

The Bank of Singapore has lowered its core earnings forecasts for the Chinese developers under its coverage, largely on weaker gross profit margin assumptions.

Concerns are also growing about Evergrande’s liquidity issues and contagion risks to the property sector and other related industries, it said.

Nevertheless, the economic growth forecast for China remains "fairly firm" at 8.2 per cent for 2021, up from 2.3 per cent in 2020, and the country's economic recovery is broadly intact despite near-term challenges, the report said.