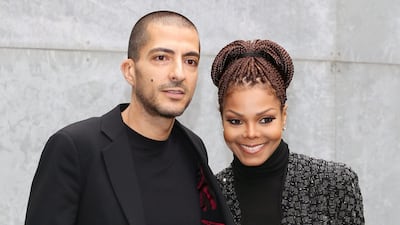

Pop star Janet Jackson has reportedly called it quits with her Qatari businessman husband Wissam Al Mana.

The Daily Mail is reporting that the star, who gave birth to their son in January, has had an amicable spilt and will take guardianship of their son Eissa from her base in London.

A source told the newspaper that they were both busy people but determined to be good parents, even if they were apart. There was speculations during their union that Jackson had converted to Islam after marrying the Arab tycoon.

The couple met during one of Jackson’s Middle East tours in 2010 and were married in 2012. Jackson was previously married to musician James DeBarge for a year in 1984 and also to dancer Rene Elizondo Jr from 1991 until 2000.

Jackson gave birth to their son on January 3, and at the time a representative told People.com that they were thrilled to welcome him into the world.

Last year, the 50-year-old star uploaded a video to Twitter announcing that she was postponing her Unbreakable world tour because she was planning a family with Mana.

aahmed@thenational.ae