Jamal Habroush Al Suwaidi, who was born in Ajman, primarily creates abstract metal sculptures that take inspiration from his country's landscape and Arabic calligraphy – the two themes that define the 45-year-old Emirati as an artist. We catch up with him about his art, influences and a recurring subject in his works – love.

Your work is mostly sculptural – would you describe yourself as a sculptor?

I describe myself as an artist. I started like any artist, by using and discovering different materials and techniques, and I used to paint landscapes on canvas and practise photography. However, with time, I found myself more attracted to sculpture, because working with three dimensions is more rewarding for me as an artist.

Why do you choose to work mostly with metal?

Metal means a lot to me because of its nobility. I work with bronze, which has a very important place in the history of art – it was one of the first alloy materials that man worked with. By choosing to use bronze, I feel that I am following a tradition that goes back thousands of years.

I also work with stainless steel, which acts like a bridge between the classical and the contemporary pieces of art that I have made during my career. I also like using this material because of its reflection and clarity.

Do you take inspiration from other artists?

My first inspiration in sculpture comes from the work of an American-Japanese artist and landscape architect named Isamu Noguchi. I like the fact he makes public sculptures, and his connection to Abstract Expressionism. Robert Indiana is also one of my favourite artists. His work is successful because of his use of colour, form and simplicity, and he inspired me, especially with my latest work, Love-Red, made of fibreglass.

You have created several works titled Love. Are they inspired by those artists' work?

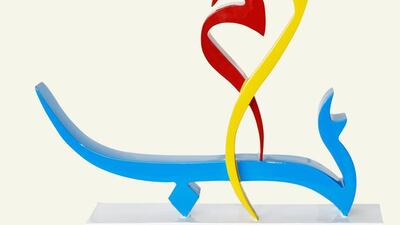

Yes, I was inspired by Indiana's iconic sculpture titled Love, which currently stands near Central Park, in Manhattan, New York. In my sculpture named Love-Red, the inspiration by Robert Indiana is present in the colours I chose and the subject, but not in the form. Love here is translated into Arabic [as hobb], which is my native language. Here I finally arrived to combine a pop-art piece with Arabic calligraphy letters.

In your artist statement you say you are inspired by the natural world of the UAE – the sea, deserts, mountains – yet your work is mostly calligraphic. How do you combine the two influences?

When I was a student, I dreamt of creating art that highlights our rich cultural history, and now, for my art, I like combining Arabic calligraphy letters with the forms from the nature of my country. For example, I can make a sculpture that uses the word for sea and has the movement of waves. Another one of my works, Ambition, represents a falcon on a stand – the stand is made of the Arabic letters for the word "ambition".

You have witnessed massive changes in the UAE’s art scene. What is the best thing about these changes and how have they helped to further your career?

Now we have a lot of galleries that represent a varied selection of artists from all around the world, and the eclectic spaces they have are very important for the art scene in the UAE. All of this helps collectors to find what they like, as well as for the artists to develop their artistic careers by taking inspiration from each other.

Are you represented by a gallery?

Yes, I’m represented by ProArt [in Dubai]. It’s an amazing gallery that specialises in modern and contemporary art and has a great collection of artists, both established and emerging. They are also professional art advisers, which I find very useful for my career.

• Visit jamalalsuwaidi.com

aseaman@thenational.ae